The Silent Revolution: Google's E-commerce Endgame

The inside story of how Google plans to win back product search.

Many of us have seen the content featured on Search Engine Land about Google's latest SERP changes. And if you're like most people in our industry, you've probably noticed how e-commerce queries are looking dramatically different these days.

But here's the thing - this isn't just another update. We're witnessing something much bigger.

Today, we see many people simply observing Google's actions, unsure where to focus their attention.

Let's dive deeper instead of just waiting.

The Beginning: more than just another update

Remember Brodie's tweet that first caught everyone's attention? That wasn't just a random test - it was the beginning of something bigger. Since 2022 (and probably earlier), Google has been systematically experimenting with their SERP layouts, particularly for e-commerce queries.

Now, with all the collected data, they're aiming for a new and robust SERP appearance.

First came the visual matches. Then the filters. And now? Well, as Search Engine Land perfectly put it:

"Retailers: Google is becoming your new category page."

But to understand why these changes matter, we need to look at the bigger picture.

The Amazon Effect: The Elephant in the Room

Let's get real for a moment. The simple answer is user behavior, but there's more to this story.

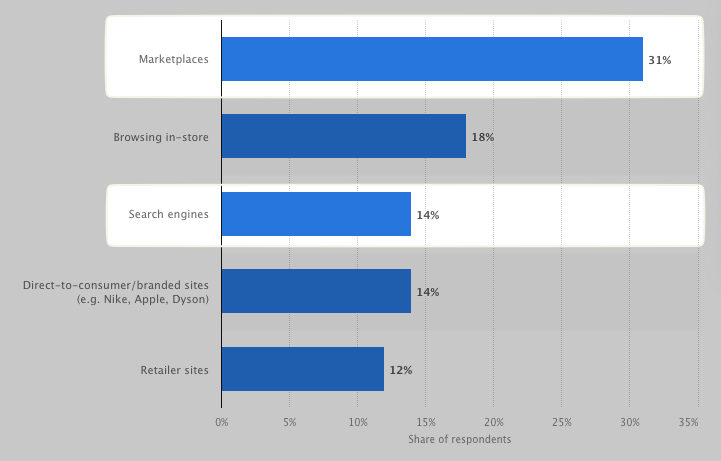

The numbers paint a clear and compelling story:

Recent Statista data from September 2024 tells us something fascinating about how people shop online:

Marketplaces dominate with 31% of product searches

Amazon leads these marketplaces (no surprise there)

European markets show a clear preference for Amazon over Google for initial product searches

This isn't just about numbers - it's about changing user behavior. And Google knows it.

Another revealing dataset from Statista shows "Share of online shoppers searching for products on Amazon and Google in selected European markets in 2022."

Amazon continues to dominate as the world's largest marketplace, with users often choosing Amazon over Google for their initial product searches.

To truly appreciate where we're heading, we need to understand where we've been.

The Evolution: From Froogle to the Future

Here's a fun fact that many people forget: Google has been trying to crack the e-commerce code since the early 2000s. Remember Froogle? That quirky name was Google's first serious attempt at product search.

Yes, Google once had a separate algorithm solely dedicated to delivering the most relevant products to searchers.

Each iteration brought us closer to today's reality. But here's what makes the current changes different: Google isn't just updating features - they're fundamentally rethinking how people discover products online.

Now that we've established the historical context, let's focus on present-day realities.

The Real Pain Points: What Consumers Actually Want

Interestingly, the major criticisms that SEO consultants and growth strategists have about marketplaces often align with consumer pain points.

Let's break down what the data is telling us about modern consumer behavior and dive into some eye-opening statistics from VML's "The Future Shopper 2024" report:

#1 Fact - The Review Reality: Content Hierarchy Speaks Volumes

Think about this: 37% of global shoppers say ratings and reviews are their #1 priority, with accurate product descriptions following closely at 35%. Brand presence (28%) and high-quality images (24%) matter, but not nearly as much as we might assume.

What's really fascinating here? Look at what's at the bottom of the influence ladder:

Video content only impacts 18% of decisions

User-generated content sits at 15%

Influencer content? Just 11%

AR experiences? A mere 8%

This tells us something crucial: consumers trust each other's direct experiences way more than polished marketing content.

#2 Fact - The Mobile Disconnect: A $36 Billion Problem Nobody's Talking About

Here's something shocking: while 36% of online spending happens on mobile, 40% of global consumers still find mobile shopping "difficult." That's not just a statistic - it's a massive opportunity gap.

But wait, it gets more interesting:

64% of global consumers want brands to make online shopping more entertaining

Nearly two-thirds wish for multisensory experiences

The current mobile experience isn't just underwhelming - it's actively pushing customers away

#3 Fact -The Price Priority: It's Not What You Think

When VML asked consumers what matters most in online shopping, price topped the list. But here's the interesting part - it's not just about being the cheapest. It's about transparency and easy comparison.

The top factors tell a more nuanced story:

Price of the item

Accurate product descriptions

Easy product discovery

Convenient delivery

Stock availability

What's fascinating is that 68% of consumers believe retailers are using inflationary crises to artificially inflate prices. This isn't just about price sensitivity - it's about trust.

This data paints a clear picture: consumers aren't just looking for the lowest price; they're looking for value, transparency, and trust.

And that's exactly where Google's new SERP strategy comes into play.

With these consumer pain points in mind, Google's strategy starts to make perfect sense.

Google's Vision: One Platform to Rule Them All

So, what's Google really trying to do here? Think of it as building the ultimate shopping assistant. They're not just showing products - they're creating an ecosystem that addresses every major consumer pain point. And when we look at the VML data, we can see exactly why each piece of this puzzle matters.

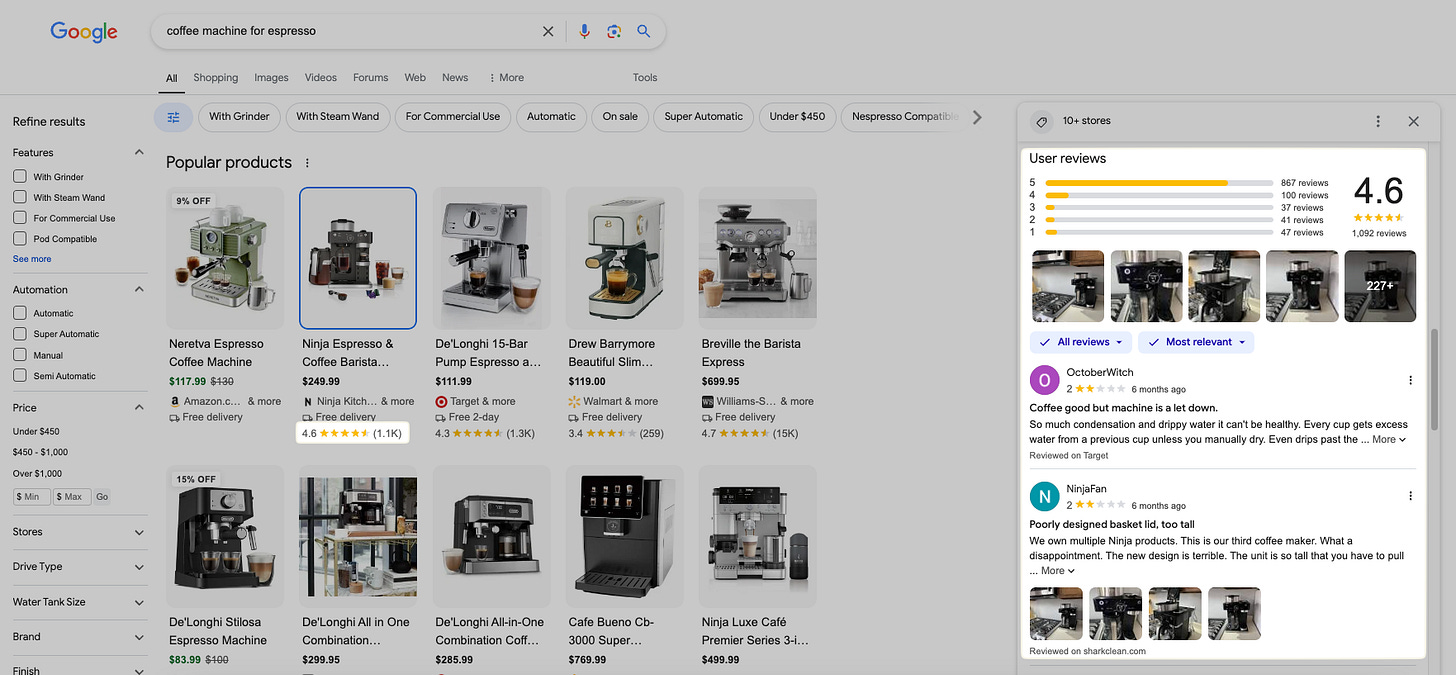

Enhanced Reviews and Ratings: Building Trust at Scale

Remember that 37% of shoppers who said reviews are their top priority? Google's not just collecting reviews - they're revolutionizing how we think about social proof:

Multi-source review aggregation (pulling trusted reviews from across the web)

Verification from multiple platforms (because one source isn't enough anymore)

One-click access to detailed feedback (no more clicking through multiple tabs)

The genius here? They're not just showing more reviews - they're making reviews more trustworthy by cross-referencing multiple sources. It's like having a focus group of thousands at your fingertips.

Smarter Product Information: Beyond Basic Descriptions

With 35% of consumers demanding accurate product descriptions, Google's approach is comprehensive:

Direct manufacturer details (straight from the source, no middleman)

Complete specifications (every detail you need to make a decision)

Feature-based comparisons (see how products stack up, feature by feature)

Think about it: when VML's study shows that accurate product descriptions are the second most important factor in purchase decisions, Google's not just listing features - they're creating a complete product story.

Price Intelligence: The Smart Shopper's Dream

Price leads VML's top ten factors for a reason, but Google's taking it further:

Real-time comparisons (see who's offering what, right now)

Alternative options (similar products at different price points)

Transparent pricing structures (including historical pricing data)

Remember that 68% who think retailers are using inflation to jack up prices? Google's price transparency tools directly address this trust gap. It's not just about finding the lowest price - it's about understanding if you're getting a fair deal.

Navigation That Makes Sense: The Mobile-First Revolution

With 40% of users finding mobile shopping difficult, Google's new navigation isn't just pretty - it's purposeful:

Meaningful attribute filters (find exactly what you want)

Customizable parameters (shop your way)

Intuitive category organization (no more endless scrolling)

This directly addresses that mobile disconnect we saw in the VML data. When 64% of consumers want more engaging shopping experiences, Google's response is to make discovery not just easier, but enjoyable.

The Integration Play: More Than Sum of Its Parts

But here's what makes this truly fascinating - it's not just about having all these features. It's about how they work together:

Reviews inform product rankings

Price history affects trust signals

User behavior shapes navigation

Product specs feed into comparison tools

Think of it as Google building the operating system for online shopping. When VML's data shows us that consumers want both better information AND better experiences, Google's not choosing between them - they're delivering both.

Remember when Amazon revolutionized online shopping with one-click ordering? This is Google's one-click discovery. They're not just showing you products; they're creating an entirely new way to find what you want to buy.

And here's the kicker: while everyone else is trying to optimize their piece of the puzzle, Google's redesigning the whole picture. They're not just competing with Amazon - they're redefining what product search means in 2024 and beyond.

But none of this happens by accident. Behind these changes lies a sophisticated technical infrastructure.

The Technical Foundation: Beyond the Surface

Google's not just throwing features at the wall to see what sticks. They're building this on some serious tech that directly addresses those pain points we saw in the VML data:

AI-Powered Discovery

Advanced overview improvements that understand user intent

Smart categorization that learns from billions of searches

Real-time relevancy adjustments based on user behavior

Semantic understanding of product attributes and features

Machine Learning That Gets You

Product matching that understands context, not just keywords

Dynamic ranking that adapts to user preferences

Smart bundling of related products and accessories

Predictive stock availability and pricing trends

The Personal Touch

Filtering that learns from your shopping patterns

Customized results based on past purchase behavior

Interest-based recommendations that actually make sense

Privacy-first personalization (because trust matters)

The "No Tab" Revolution

Single-page experience that just works (because who likes clicking through multiple tabs?)

Dynamic loading that keeps you in the flow

Contextual information that appears when you need it

Seamless transitions between discovery and decision

While we can already see the impact of these changes, the real question is: where does this all lead?

What's Next? The Road Ahead

This is just Part I of our deep dive. In Part II, we'll get into the nitty-gritty of what this means for Growth Strategists and how to adapt your strategy. But here's what we're likely to see:

Immediate Horizon (Next 6-12 Months)

Deeper Google Pay integration for frictionless purchases

Expanded marketplace partnerships across regions

Complete in-SERP purchase flow implementation

Enhanced product discovery with AR/VR elements

The Bigger Picture

AI-driven personal shopping assistants

Real-time inventory integration across retailers

Predictive shopping based on user behavior

Multi-platform synchronization for seamless shopping

The Game-Changing Possibilities

Virtual try-ons powered by advanced AR

Voice-commerce integration with Google Assistant

Social shopping features that actually work

Cross-platform cart synchronization

Will they succeed in becoming the go-to platform for product discovery? That's the billion-dollar question. But when 64% of consumers are asking for better shopping experiences and 40% find current mobile shopping difficult, Google's vision isn't just ambitious - it's necessary.

One thing's certain: ignoring these changes isn't an option. This isn't just another update; it's a fundamental shift in how people will discover and buy products online.

at Part II, we'll break down exactly how to adapt your strategy for this new reality.

We'll cover:

Optimization strategies for the new SERP

Content frameworks that actually convert

Technical implementations that get results

Measurement approaches that make sense

Good luck,

Baris.